All Categories

Featured

Table of Contents

The SEC governs the guidelines for dealing safety and securities consisting of when and exactly how safety and securities or offerings have to be signed up with the SEC and what kinds of capitalists can join a specific offering - accredited investor funding opportunities. As an online commercial realty investing market, all of our investment possibilities are offered just to approved financiers

In other words, you're an accredited investor if: OR ORYou are a holder in excellent standing of the Series 7, Collection 65, or Series 82 licenses An accredited capitalist doesn't have to be a specific person; counts on, particular pension, and LLCs may likewise get certified investor condition. Each investing ability may have slightly different standards to be thought about recognized, and this flowchart outlines the certification criteria for all entity types.

Within the 'accreditation confirmation' tab of your, you will certainly be offered the complying with options. Upload financials and documentation to show evidence of your accredited standing based upon the demands summed up above. vouching for your condition as a certified investor. The uploaded letter has to: Be signed and dated by a certified third-party; AND Clearly state the suppliers qualifications (ex-spouse, "I am a registered CPA in the State of [], certificate #"); AND clearly state that the investor/entity is an accredited investor (as defined by Policy 501a).

Reliable High Yield Investments For Accredited Investors Near Me

Please note that third-party letters are just legitimate for 90 days from date of issuance. Per SEC Policy 230.506(c)( 2 )(C), before approving an investor right into an offering, sponsors need to get written proof of an investor's accreditation status from a qualified third-party. If a third-party letter is supplied, this will certainly be passed to the sponsor straight and has to be dated within the past 90 days.

After a year, we will certainly require upgraded financial records for review. For more info on accredited investing, see our Certification Summary short articles in our Assistance Center.

The test is expected to be available at some point in mid to late 2024. The Equal Possibility for All Investors Act has already taken a significant action by passing the Home of Reps with an overwhelming vote of support (383-18). high return investments for accredited investors. The next stage in the legislative process includes the Act being assessed and voted upon in the Us senate

Specialist Accredited Crowdfunding – Portland

Offered the rate that it is moving currently, this might be in the coming months. While exact timelines doubt, provided the substantial bipartisan backing behind this Act, it is anticipated to progress via the legislative process with relative speed. Presuming the 1 year home window is supplied and achieved, means the message would be available at some time in mid to late 2024.

For the typical capitalist, the monetary landscape can sometimes feel like a complex labyrinth with limited access to certain financial investment opportunities. The majority of financiers do not qualify for accredited financier status due to high income degree needs.

Tailored Investment Opportunities For Accredited Investors

Join us as we demystify the globe of recognized financiers, unraveling the significance, demands, and possible advantages related to this classification. Whether you're new to spending or looking for to broaden your financial perspectives, we'll lose light on what it indicates to be a recognized capitalist. While organizations and banks can receive recognized financial investments, for the objectives of this article, we'll be discussing what it indicates to be a certified financier as an individual.

Exclusive equity is additionally an illiquid possession course that seeks long-term admiration away from public markets. 3 Personal placements are sales of equity or financial obligation settings to competent financiers and establishments. This sort of investment usually offers as an alternative to various other approaches that may be required to increase funding.

7,8 There are numerous downsides when taking into consideration a financial investment as an approved financier. 2 The financial investment vehicles offered to accredited financiers usually have high investment needs.

A performance charge is paid based on returns on an investment and can range as high as 15% to 20%. 9 Several approved financial investment cars aren't easily made liquid should the need emerge.

Leading Investment Opportunities For Accredited Investors – Portland

The info in this material is not meant as tax obligation or legal advice. It may not be used for the objective of preventing any type of government tax charges. Please get in touch with legal or tax obligation experts for specific details concerning your specific scenario. This material was developed and generated by FMG Suite to give info on a topic that may be of rate of interest.

The viewpoints revealed and material provided are for basic details, and must not be taken into consideration a solicitation for the acquisition or sale of any kind of protection. Copyright FMG Collection.

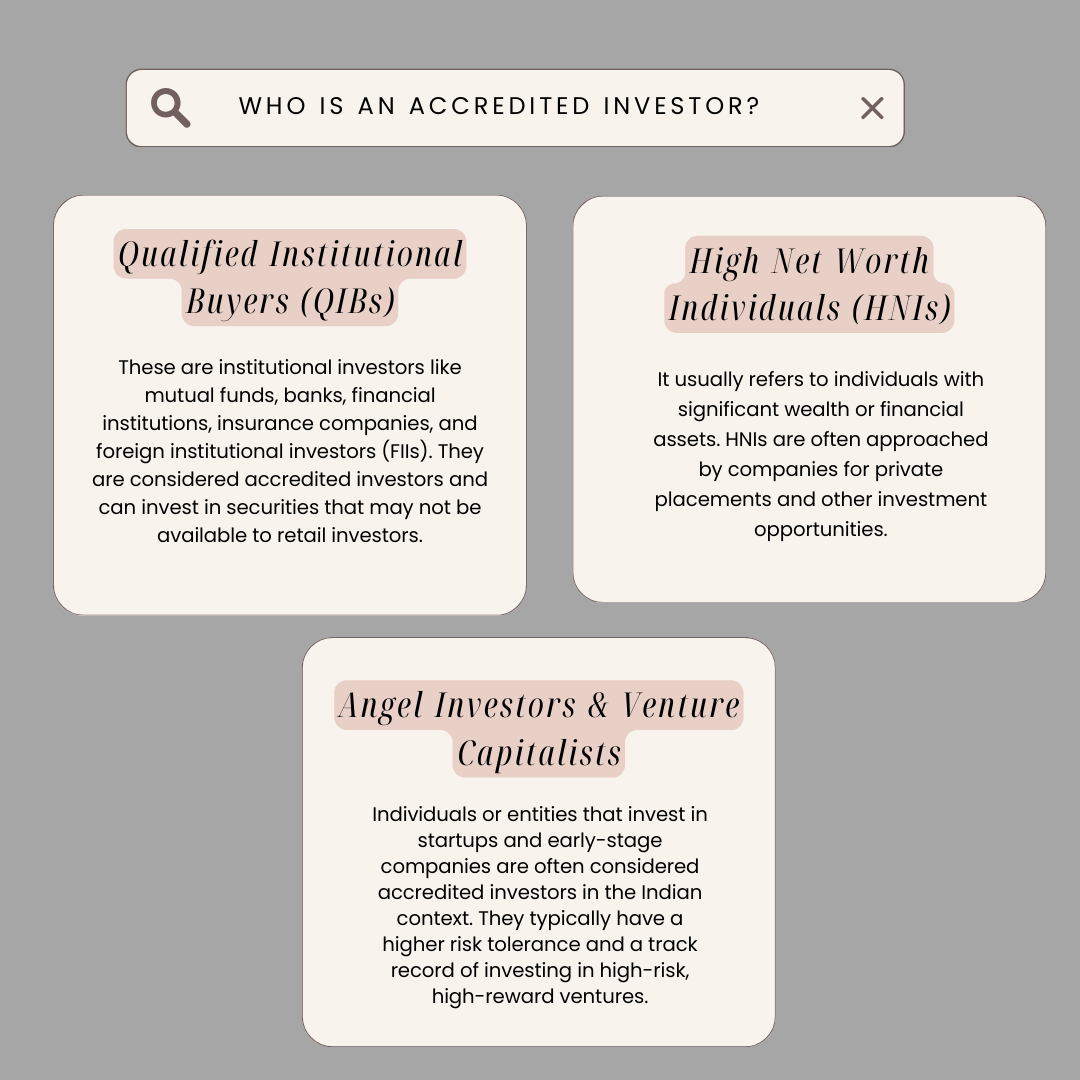

Accredited financiers consist of high-net-worth individuals, financial institutions, insurer, brokers, and trust funds. Accredited financiers are defined by the SEC as certified to buy complex or sophisticated kinds of protections that are not very closely managed. Specific standards must be satisfied, such as having an ordinary yearly income over $200,000 ($300,000 with a partner or cohabitant) or operating in the financial industry.

Non listed safeties are inherently riskier due to the fact that they lack the normal disclosure demands that come with SEC registration. Investopedia/ Katie Kerpel Accredited capitalists have blessed access to pre-IPO firms, venture funding business, hedge funds, angel financial investments, and numerous deals entailing complicated and higher-risk financial investments and tools. A firm that is looking for to increase a round of funding might determine to straight approach certified investors.

High-Quality Accredited Investor Opportunities – Portland

Such a firm may decide to provide securities to accredited financiers directly. For approved investors, there is a high capacity for threat or incentive.

The laws for certified capitalists differ amongst territories. In the U.S, the interpretation of an accredited capitalist is presented by the SEC in Policy 501 of Guideline D. To be an accredited financier, an individual needs to have a yearly earnings surpassing $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of making the same or a greater earnings in the current year.

A recognized capitalist ought to have a web worth exceeding $1 million, either independently or collectively with a partner. This quantity can not include a primary home. The SEC likewise considers applicants to be approved investors if they are general partners, executive policemans, or directors of a firm that is releasing unregistered safeties.

Additionally, if an entity includes equity owners who are certified financiers, the entity itself is a certified capitalist. A company can not be developed with the sole objective of buying details protections. A person can qualify as a recognized capitalist by showing sufficient education and learning or task experience in the monetary market.

Table of Contents

Latest Posts

Claim Excess

House Tax Foreclosures

Tax Foreclosure Information

More

Latest Posts

Claim Excess

House Tax Foreclosures

Tax Foreclosure Information